(…and how to fix them)

The urgent opportunity: Millions on the table

The logistics industry is under pressure from rising costs, customer expectations, and international politics, leading to lagging demand.

While companies focus on cost reduction and operational agility, many overlook pricing. Pricing leakage is a significant issue, as even a 1% price increase can lead to a 10% profit boost, far more than increases in volume or cost reduction. Ignoring pricing problems can result in millions in lost annual revenue and profits.

The good news? It is possible to overcome these challenges. Carriers who adopt the right practices in pricing can systematically protect and grow their margins. Imagine this: a simple 3–5% increase in your margins could add €15–25 million annually to your bottom line if your company makes €500 million in revenue. This isn’t hypothetical — it’s the proven reality for carriers who fix their pricing.

Let’s look at the four most common pitfalls — and how leading carriers are turning them into opportunities.

1. Selling without guidance: The silent margin leakage

Many sales teams operate without clear guidelines, lacking access to target and “walkaway” prices. This leads to inconsistent deals, revenue leakage, and eroded margins.

What Best-in-Class Carriers Do

They equip their teams with real-time guided pricing recommendations at the deal level. With clear boundaries and smart guidance, salespeople can negotiate faster and more confidently — while protecting margins. Open Pricer’s platform provides real-time deal guidance that empowers sales with the right targets and walkaway prices for every customer segment. As Bertrand Viguier, Account Manager at Chronopost explains: “The validation workflow enables me to build quotes faster for my customers. Most importantly, I know my negotiation margin for all products in relation to their profitability.” This not only speeds up the sales cycle but also dramatically improves deal quality and negotiation efficiency.

2. Competing on price instead of value

When a competitor drops their price, the natural instinct is to follow suit. But this “race to the bottom” ignores what makes your service unique—its value. You risk giving away margin on your most profitable products and services.

What Best-in-Class Carriers Do

They apply value-based pricing: segmenting customers, simulating willingness to pay, and aligning price to value delivered, not just on what the competition is charging. This approach allows you to capture a greater share of the customer’s willingness to pay. Open Pricer’s segmentation and value-based simulation tools allow you to model and predict the potential impact of different pricing strategies. By capturing the full value of your service, you can boost your EBIT by as much as 4% or more instead of leaving money on the table.

3. Flawed profitability simulations

Relying on an “average shipment profile” to build quotes creates up to 5% errors. Averaging ignores the real weight, volume, and distance distribution of shipments — and it leads to systematic revenue shortfalls.

What Best-in-Class Carriers Do

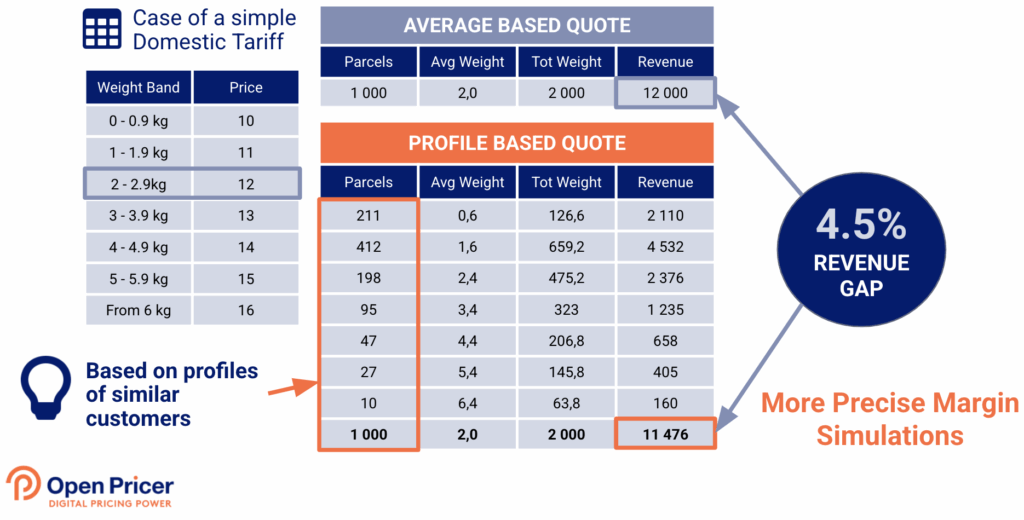

They base quotes on actual shipment profiles, leveraging historical data to build realistic simulations. A more accurate simulation based on a customer’s real shipping mix (weight, volume, distance, etc.) ensures that you are quoting on a profitable basis. Shipping Profiler, provided by Open Pricer, uses real shipment mixes from similar customers when the profile provided in a quote is incomplete. This improves revenue and margin simulation accuracy by up to 5%. For instance, Imagine quoting based on an “average parcel weight” of 2 kg. For 1,000 parcels, this looks like €12,000 in revenue. But when the true distribution is applied — with most parcels in lower weight bands — actual revenue drops to €11,476. That’s a 4.5% revenue gap (see Figure 1).

Figure – 1 Profile-based quotes are more precise Average-based

For parcel and road freight carriers, average-based quotes distort pricing accuracy. Using shipment profiles reduces revenue leakage by 4.5% and improves profitability simulations.

4. Slow to adapt to market shifts

Fuel, labor, and competition costs evolve daily. Yet many carriers update their prices only once or twice a year. The lag leaves margins exposed.

What Best-in-Class Carriers Do

They adopt continuous, data-driven tuning of their pricing policies. Instead of reacting months later, they adjust in near real-time. Open Pricer’s dynamic pricing engine updates tariffs continuously, ensuring that pricing stays aligned with cost structures and market dynamics.

This goes with price revision: setting the right price at a given time is one thing, but it needs to be renegotiated every year to ensure the right price is still enforced, as market conditions change every year.

Don’t let pricing mistakes drain your profits

In the current competitive environment, carriers cannot afford to rely on guesswork when setting prices. Without the right processes and tools, even the most experienced pricing teams risk leaving millions on the table.

Finding the right price is only the beginning. The next challenge lies in enforcing pricing discipline, automating governance, and continuously monitoring performance to ensure that margins are not eroded over time. Don’t miss Part 2 of this series next week.

For those ready to accelerate their pricing transformation, discover how Open Pricer can help you gain pricing clarity, protect margins, and unlock profitable growth.

Book a demo with our experts to see how leading carriers are already succeeding with Open Pricer.

Learn more on our latest pricing insights:

Read Pricing mistakes that make carriers lose margins Part 2

Read From cost cutting to value creation : How pricing systems protect carriers’ margins

Read Mastering Pricing System Implementation: A Strategic Guide for Pricing Managers